When managing a facility or a business that requires housekeeping services, one of the most important aspects to keep track of is labor costs. Housekeeping services are an essential part of maintaining clean, safe, and comfortable environments for employees, guests, or customers. However, the cost of housekeeping labor can quickly add up, and it’s crucial to create a well-thought-out labor budget. This is where a HSKP Labor Budget Template becomes an invaluable tool.

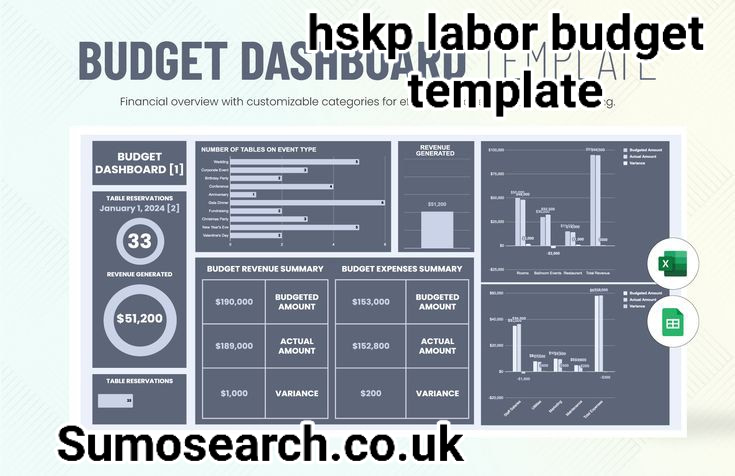

An HSKP labor budget template allows facility managers and hskp labor budget template business owners to plan, track, and manage labor costs effectively, ensuring that housekeeping services are provided efficiently without overspending. In this comprehensive guide, we will explore what a housekeeping labor budget template is, how to use it, its benefits, and why it’s essential for businesses that rely on housekeeping services.

What is an HSKP Labor Budget Template?

An HSKP (Housekeeping) Labor Budget Template is a structured tool that helps facility managers and business owners plan and hskp labor budget template track the labor expenses associated with housekeeping operations. It typically outlines the number of hours required for cleaning tasks, the hourly wage of employees, and other labor-related expenses. This template helps in allocating the right amount of labor to different housekeeping tasks, such as cleaning, maintenance, and other essential services, while ensuring that costs stay within budget.

Labor costs can be one of the largest expenses in any housekeeping operation. Therefore, an HSKP labor budget template helps optimize these costs, enabling hskp labor budget template businesses to deliver top-notch services without exceeding their financial resources.

Key Components of an HSKP Labor Budget Template

A well-designed HSKP labor budget template typically includes several key components. Each of these elements plays a crucial role in ensuring hskp labor budget template that the housekeeping labor budget is realistic and efficient.

Benefits of Using an HSKP Labor Budget Template

There are numerous benefits to utilizing an HSKP labor budget template, including:

- Cost Control and Efficiency One of the main advantages of using an HSKP labor budget template is the ability to control labor costs. By clearly outlining the amount of labor required for each task, businesses can ensure that they do not overestimate or underestimate staffing needs. This leads to better planning and more efficient use of resources.

- Improved Financial Forecasting Accurate labor budgeting is key to effective financial forecasting. An HSKP labor budget template helps businesses predict future costs more accurately, allowing them to allocate resources effectively and avoid overspending.

- Resource Allocation With a labor budget template, facility managers can allocate resources more effectively. Knowing exactly how many hours of work are required for each task helps in staffing the right number of employees at the right time, preventing both under- and overstaffing.

- Time Savings Instead of spending time manually calculating labor costs, a template automates the process. This can save valuable time for facility managers, who can focus on other critical aspects of operations, like ensuring quality standards are maintained.

- Streamlined Communication When all the labor requirements and costs are clearly laid out in a template, communication within the team becomes much easier. Staff members will know their specific roles and responsibilities, and managers can track labor costs with greater transparency.

- Compliance and Legal Protection In some regions, businesses are required by law to maintain certain labor records. A well-maintained HSKP labor budget template can help ensure compliance with labor laws, including wage rates, overtime pay, and benefits.

- Data-Driven Decision Making Using a template to track labor costs allows businesses to make more informed, data-driven decisions. Analyzing trends over time can provide insights into how staffing levels, wage rates, and other factors influence the overall labor budget, helping to identify potential areas for improvement.

How to Create an HSKP Labor Budget Template

Creating an effective HSKP labor budget template hskp labor budget template can be done in a few simple steps. Here’s how you can do it:

- Choose the Right Software You can create a labor budget template using a spreadsheet program like Microsoft Excel or Google Sheets, or by using specialized budgeting software that offers pre-designed templates for housekeeping operations. Choose a platform that you’re comfortable with and that supports the features you need.

- Define Your Housekeeping Tasks List all the cleaning tasks your facility requires, from daily cleaning to periodic deep cleaning tasks. Assign an estimated number of hours needed for each task. This may take some trial and error, but having this breakdown will make it easier to allocate labor.

- Set Wage Rates Input the hourly wage rates for your housekeeping staff. If your workers perform different types of tasks, ensure you have the correct rates for each category.

- Account for Benefits and Additional Costs Don’t forget to include benefits, insurance, taxes, and any other labor-related expenses. These can significantly impact your total labor costs.

- Input Historical Data If available, use historical data to estimate how many hours of labor were required in previous months or years. This will help you create a more realistic budget.

- Review and Adjust Once your template is filled out, review it to ensure that all costs are accounted for. Adjust as necessary based on the size of your facility, staff availability, and other variables.

Common Mistakes to Avoid

When creating an HSKP labor budget, there are a few common mistakes to watch out for:

- Underestimating Labor Hours One of the most common mistakes is underestimating how much time it takes to complete certain housekeeping tasks. It’s always better to overestimate labor hours to avoid running short of staff.

- Ignoring Overtime Costs Many budgets fail to account for overtime or shift differentials, which can lead to unexpected labor costs. Always include a cushion for overtime, especially during peak periods.

- Not Considering Benefits and Taxes Focusing only on wages can give you a false sense of the total cost of labor. Always factor in benefits, taxes, and other costs when creating your budget.

- Failure to Adjust for Seasonal Changes Many businesses experience fluctuations in labor needs based on the time of year. Be sure to account for seasonal changes in your budget to avoid over or understaffing.

Conclusion

An HSKP labor budget template is a powerful tool that allows businesses to manage their housekeeping labor costs effectively and efficiently. By using a detailed and structured template, businesses can gain better control over their expenses, allocate resources more effectively, and make more informed decisions. Whether you’re managing a hotel, office building, or any other facility that requires housekeeping services, a labor budget template is an essential resource for staying within budget while maintaining a high standard of cleanliness and customer satisfaction.

FAQs About HSKP Labor Budget Template

- What is the purpose of an HSKP labor budget template? The purpose of an HSKP labor budget template is to help businesses plan and manage their housekeeping labor costs efficiently. It helps facility managers track labor hours, wages, and other expenses, ensuring that costs remain within budget.

- Can I customize an HSKP labor budget template? Yes, most HSKP labor budget templates are customizable. You can adjust the categories, rates, and hours based on the specific needs of your business or facility.

- What are the main components of an HSKP labor budget template? The main components include staff hours, job classifications, hourly wages, cleaning tasks and time allocation, overtime costs, and any additional labor-related expenses like benefits and taxes.